Ava’s Evolving Value Proposition

Sep 17, 2024

Ava has to deal with shifting conditions as PG&E rates rise, market prices jump up and down, and demand for new clean generation and storage heats up. This makes forecasting revenues and budgets tricky.

To put it simply, Ava’s rates reflect Ava’s cost to serve customers. But the combination of wholesale energy prices and state regulations can create a shifting picture for Ava’s finances, with revenues and expenses moving by tens of millions of dollars each year. Since Ava errs on the side of caution in its financial planning, we have been able to invest in local programs, invest in local generation, build up financial reserves, and still return some rate collections to customers.

Still it’s hard to know the exact numbers in advance. This year’s budget anticipates a revenue surplus in 2025, though one smaller than seen in recent years.

Revenues and Expenses?

To understand Ava’s budget dynamics, a few things first: Ava customers pay Ava only for electricity generation. Ava customers pay PG&E to deliver that electricity. PG&E also buys and generates power for its own customers.

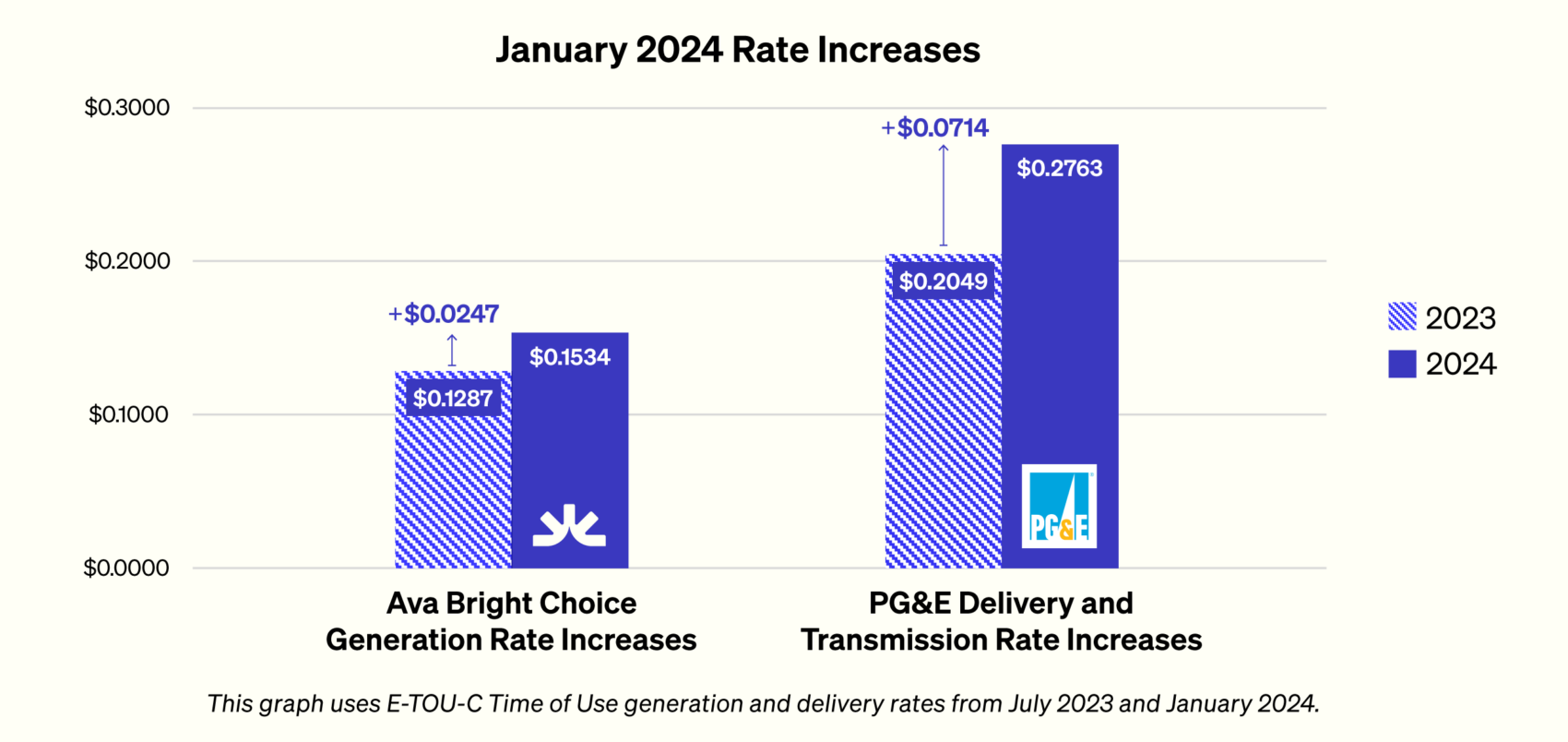

On the generation part of the bill, Ava’s board has pegged Ava’s electricity generation rates to PG&E’s generation rates, to ensure that Ava customers can save money compared to PG&E. The cost of Ava’s Bright Choice product is set at 5 percent below PG&E’s standard rate for generation, while Ava’s Renewable 100 — all solar and wind power — is a quarter-cent higher than PG&E generation rates per kilowatt-hour (less than a dollar a month extra for the average residential customer).

On the delivery part of the bill, Ava customers pay PG&E for delivery costs. Delivery rates exceed the rates for electric generation and have been rising substantially the past few years. Those delivery payments don’t affect Ava’s revenues and expenses.

PG&E’s generation costs are different from Ava’s, since PG&E buys its electricity from different sources than Ava does. In recent years, PG&E’s generation rates have been rising, pulling up Ava’s rates. Because Ava’s cost structure for Bright Choice is lower than PG&E’s for a comparable product, Ava’s discount off PG&E’s generation rate has increased over time. Indeed, the Ava discount used to be only 1 percent less than PG&E in 2021, but was raised to 3 percent and then 5 percent to minimize rate increases for Ava customers.

Ava’s biggest expense is the electricity and capacity it buys for customers. In April, Ava hit a milestone, contracting for one Gigawatt (1,000 Megawatts) of renewable energy projects and saving customers more than $100 million since 2018. Even since making that announcement Ava has saved customers an additional $10 million.

The cost of new renewable energy contracts has been rising, as permitting costs, supply chain challenges, and interconnection costs have plagued the generation sector. This is likely to persist through 2030 at least, gradually increasing Ava’s costs. The supply of new renewable resources is not keeping pace with demand. On the demand side, Fremont is the latest Ava member city to set Renewable 100 as the default supply for their customers, starting for residential customers in August 2025. As one of Ava’s largest cities, this will require a substantial amount of new renewables procurement.

Rates Up and Rates Down

Rates are set annually based on forecasts of market conditions for the coming year. Those forecasts may not end up reflecting actual market conditions.

“Actual energy prices from January to April 2024 were very soft,” said Howard Chang, Ava’s new CEO, at the board meeting in June. “A very mild winter, not just here but nationwide, plus a good supply of natural gas and low prices, all led to lower energy prices.”

As a result, Ava and PG&E had lower procurement costs than expected. However, low wholesale energy prices cause a wrinkle that also raises prices. Ava customers have to pay PG&E for the above-market cost of resources contracted for or built to serve them before they departed PG&E’s service, a fee known as the Power Charge Indifference Adjustment (PCIA). If wholesale prices are high, those legacy plants bring in enough money to cover their costs. If prices are low, Ava customers have to pay to make up the difference.

The PCIA rate hit a high of 4¢ per kilowatt-hour in 2022. Rising wholesale prices after that caused a decline in the PCIA to 1¢ or less for many Ava customers in 2024. Lower wholesale energy prices in 2024 (and likely 2025) mean a higher PCIA in the coming year.

Ava customers will be stuck with the PCIA for some time. “The PCIA starts to trail off over 15 years,” said Chang. “Some goes to pay for utility-owned resources, some for 10 to 20 year contracts. With most of our member communities having departed PG&E seven years ago, any contracts they had in place at the time are part of the PCIA, and they will gradually trail off.”

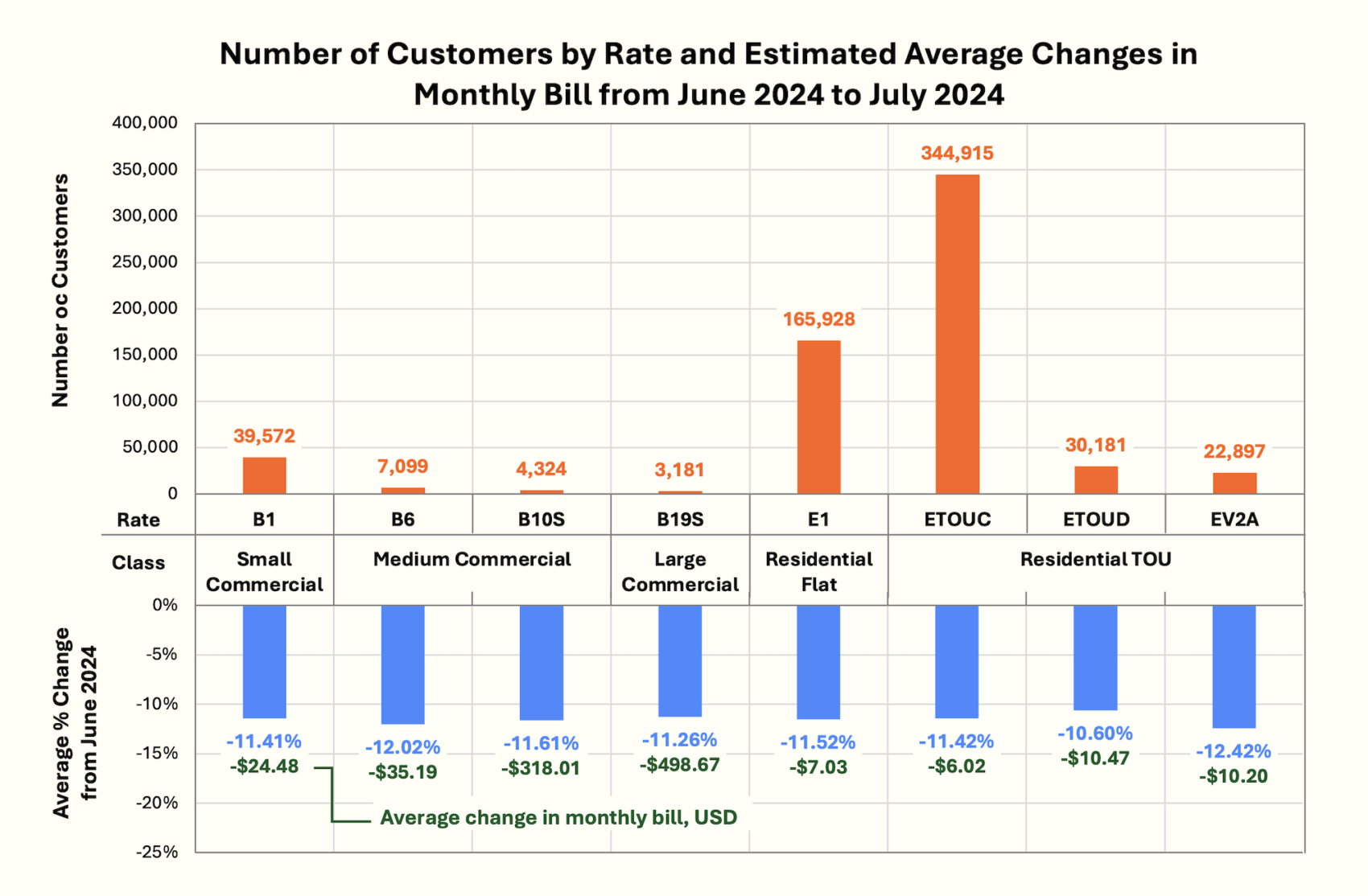

On July 1, PG&E decreased their rates across generation, transmission and distribution by 9.3 percent. In response, Ava decreased generation rates by an average of 12 percent for all customers.

What to do with Unbudgeted Net Revenues

Nonetheless, Ava is still likely to see higher-than-budgeted net revenues in the coming year. Meeting on June 12, the board approved some plans for these funds, contingent on how finances play out the rest of this year.

The first $50 million would be added to Ava’s financial reserve fund. In addition to preparing for any unforeseen problems, a reserve fund also lowers Ava borrowing costs. One area with unknowns could be in expanding service to Stockton and Lathrop in the coming year, Ava’s newest member cities to start service. Stockton will be the second largest member city after Oakland, boosting Ava’s annual electricity sales by 20% and increasing the number of accounts by 17%. That will increase operating expenses, along with revenues.

The board approved a customer bill credit dependent on a certain threshold of surplus revenue from this last fiscal year. The exact amount of surplus is not yet known, but a bill credit is forthcoming this fall and will be slightly higher for CARE and FERA customers compared to other residential customers. CARE and FERA customers will also enjoy lower rates, saving $30-40 over the coming year.

Next, if the budget allows, about $10 million will be allocated for incentives for customers with solar and storage systems whose benefits were cut by recent regulatory decisions.

Any further remaining amounts will be added to reserve funds.

“There is commentary that says our reserve balance is significant, and that is true,” said Chang. “But our annual operating expense is going to be over a billion dollars, which is a very big number.”

Chang says Ava is still building up the reserve fund to meet board-set levels. “That’s what we are trying to move toward as quick as we can, while still being mindful of ways we can provide savings and benefits to our customers.”