EBCE on ICE: Saving Money Through the Intercontinental Exchange

Jul 21, 2023

EBCE is trying out a new market mechanism for power procurement, to manage risks and potentially save money.

EBCE has signed up with the Intercontinental Exchange, an online marketplace that promises to reduce risk and volatility in buying and selling power.

The Exchange, known as ICE, was founded in 2000 and has spread to energy markets around the world. It offers a number of buying options, hedges, and a bigger pool of market participants to provide more flexibility and precision.

EBCE locks up 80 to 90 percent of its power supplies well in advance. So far EBCE has signed long term contracts supporting 12 new projects with just over one gigawatt of generation and storage capacity. Those power plants deliver power at certain times and places, or in the case of wind and solar plants, they deliver power when it is produced. EBCE manages a portfolio of supplies to keep the lights on 24×7.

Risk Factors

But prices can change between the time a future transaction is scheduled and the time it happens.

Electric market prices are often driven by natural gas power plants, the “marginal” resource, called on when other resources are not available. Their power prices are partly dictated by natural gas fuel prices, and fuel prices can be affected by production, transport, and storage issues. For example, the blowout at the Aliso Canyon storage facility in 2015 increased the price and volatility of California gas for years.

And as gas producers build more capacity to export liquified natural gas (LNG), US prices are increasingly linked with global prices, and can be affected by international issues like the war in Ukraine. LNG exports rose last year to account for over 10 percent of gross US gas production, and are expected to rise further.

In California, this year’s wet winter will also affect power prices. The Sierra snowpack is well above normal levels; as it melts, hydropower production will be high, reducing electricity market prices.

Policy changes can also affect regional prices. Washington state recently adopted a carbon price that was higher than expected, about twice California’s carbon price.

These variables put a premium on good forecasting, which is why EBCE is investing in state-of-the-art data tools.

But forecasting can never be perfectly accurate. Last minute variables like hot weather or a power line outage may drive up prices, creating an unpleasant surprise. Or good weather and low demand can reduce prices, saving money instead.

To protect against surprises, EBCE relies on financial hedges to manage the risk of the last 10 to 20 percent of power supplies not locked up in long term contracts.

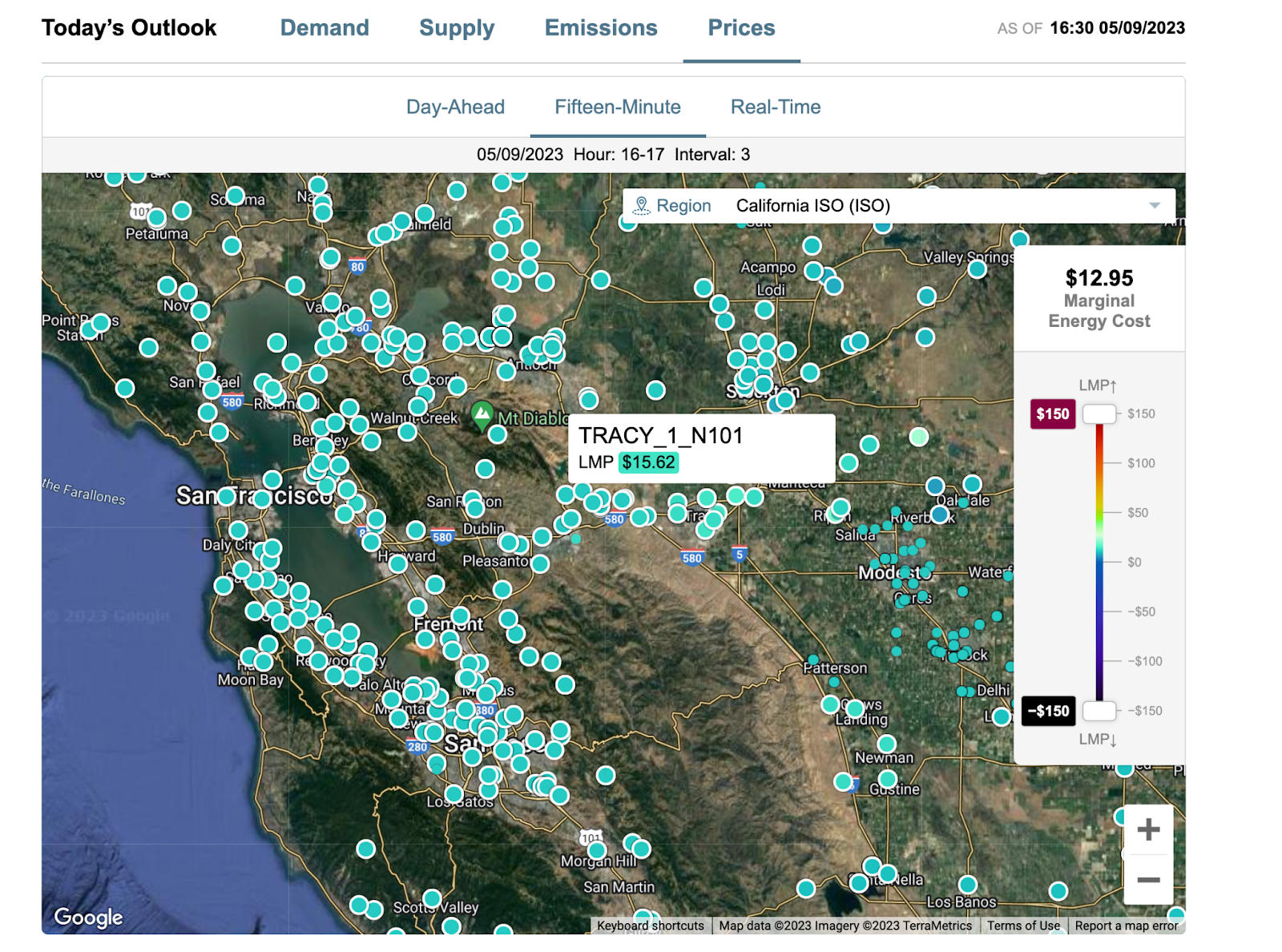

CAISO’s market map, showing 15-minute interval prices on a spring afternoon in the Bay Area. (Source: CAISO Today’s Outlook)

Market Makers

The main market for electricity sales in California is run by the California Independent System Operator (CAISO), based in Folsom. The CAISO market offers sales that happen the next day, the next hour, and right now, for three primary locations across the state.

But CAISO’s short-term markets are not that active, according to EBCE’s Chris Eshleman, Director of Energy Analytics and Electric Supply.

“The volume for day ahead and day-of markets is much smaller than other markets around the country, like the one in Texas for example,” he says. “It is not a very liquid market.”

This is where ICE steps in, selling “futures,” or the right to buy or sell power at a certain price at a future time and place. ICE offers different CAISO market products by place and type of transactions. The “CAISO SP-15 Day-Ahead Peak Fixed Price Future,” for example, is a futures contract based on the daily average of peak hour electricity prices for transactions in Southern California. ICE offers a bewildering set of related options that allow finely tuned hedges for various situations.

Dealing on the ICE marketplace offers a number of benefits, according to Eshleman.

“The first use is for hedges, to manage the risk of high prices,” he says. “We lock in a price in advance, but the price is often pegged to a market that floats. Like if we bought power now for next January, prices may be very different by then. If it goes up or down, it creates risks for us.”

Another advantage is to diversify the pool of buyers and sellers.

“Because CAISO volumes are pretty low, there may be only five sellers at a given time,” he says. “With the ICE marketplace there could be up to 20 players, which makes for a deeper pool of transactions and more options.”

“Also, the Exchange provides a clearing process that takes on some of the risk,” he adds. “In a transaction between two parties, each has their own bank, and the banks clear the transaction via the Exchange. This bank-to-bank transaction eliminates some of the risk to us, like if the counterparty defaults.”

Minding the Guardrails

Since joining, EBCE has been lurking on the exchange, but has not executed any transactions yet.

“We want to see how the ICE products fit in with our procurement strategies,” says Eshleman. “We plan to be pretty light at first, for both quantity and tenor [the length of transactions].”

“If it goes well we can release the guardrails.”