How Investor-Owned Utility Charges Drive Up Community Choice Aggregator Rates

Jul 26, 2024

by Howard Chang, CEO of Ava Community Energy

Source: NewsData

Pacific Gas & Electric has grabbed headlines in recent months for the huge rate increases that it claims are needed to pay for safety improvements to its system.

Those increases are affecting Ava Community Energy customers, who pay Ava for electricity and pay PG&E to have it delivered. In fact, Ava customers pay twice as much to PG&E to have power delivered as they do for the electricity itself. Ava’s own charges have risen only a little, even as we expand our portfolio of clean energy and ramp up our local programs. But overall bills for Ava customers are rising, in large part due to higher PG&E charges.

In our recent newsletter, we went in depth on how rates are designed, how expenses are allocated, and what is driving rate increases. The California Energy Markets audience likely knows most of that already, so I’m going to focus on a few toplines.

What’s Up? Rates!

In November, the California Public Utilities Commission authorized a 10.7-percent increase in revenues for PG&E over the previous year—one of the largest rate increases in the company’s history, and marking PG&E as the “most expensive power provider (PDF)” in the state, surpassing San Diego Gas & Electric. In early March, regulators approved another increase, raising bills another $5 per month for the average household.

According to the CPUC’s Public Advocates Office, PG&E rates have risen 127 percent since 2014, well above the 30-percent increase from rate of inflation, which was 30 percent over the last decade.

California now has some of the highest electricity rates in the country, though this is tempered by the fact that California households consume less energy than average U.S. homes—due to mild climates and years of policy in support of energy-efficient homes—resulting in only average bills (PDF).

Still, high rates increase the energy burden for low-income households, can drive away energy-intensive businesses, and are an impediment to electrification, where customers replace polluting natural gas and gasoline with clean electricity to cut carbon emissions.

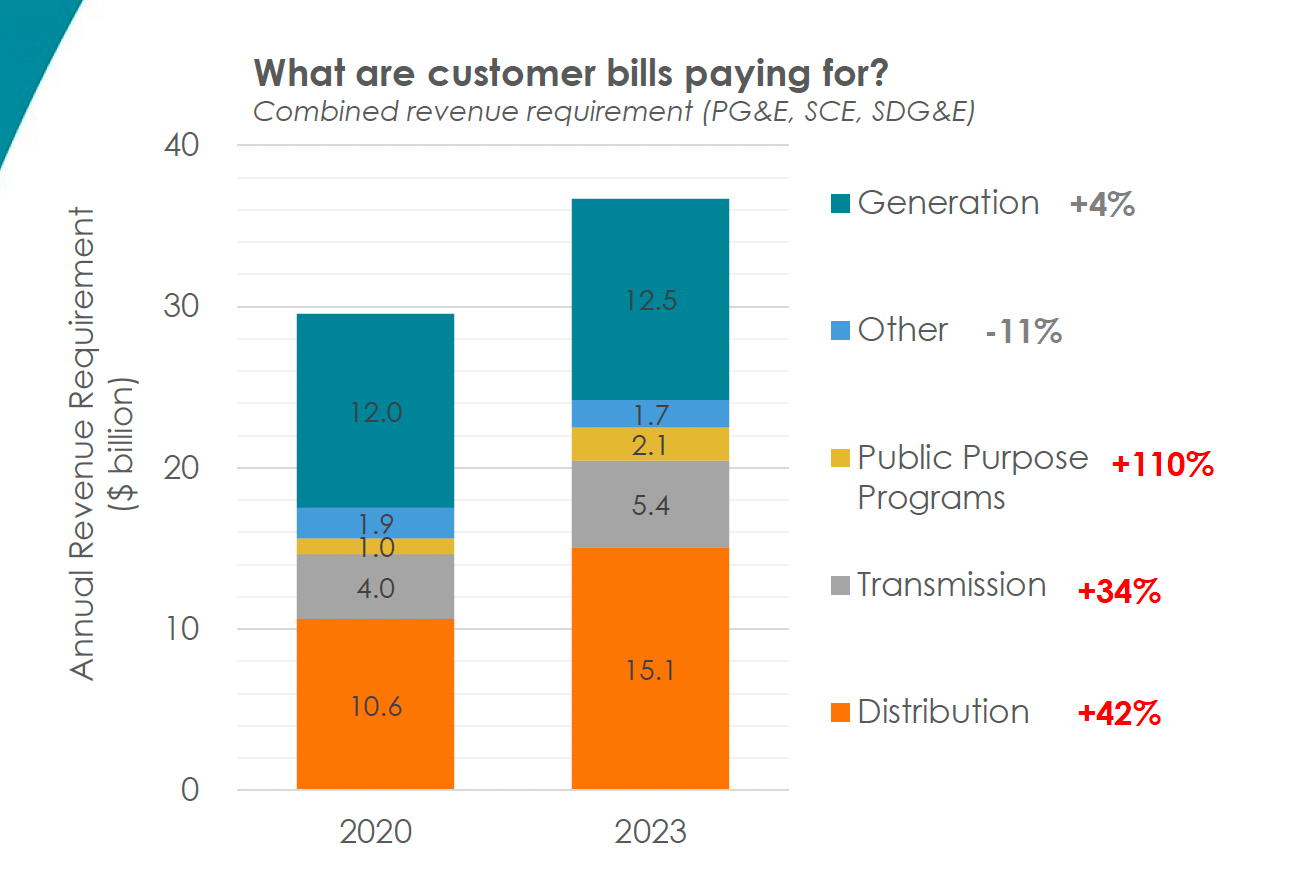

The discussion about rising rates in the popular press has tended to obscure the cause—rates are rising mostly due to transmission and distribution costs, and mostly to prevent wildfires. Cal Advocates points out that while generation costs rose a half-cent from 2020 to 2023, T&D costs rose 5.9 cents/kWh. Public-purpose programs doubled, adding another 1.1 cents.

Source: CPUC Public Advocates Office

PG&E estimates that more than 85 percent of the increase in its most recent general rate case will be used to “reduce risk” in its operations. To PG&E, this means putting power lines underground in high-fire-risk areas, expanding tree-trimming operations, deploying better grid monitoring and controls, and replacing and repairing over 150 miles of gas pipelines.

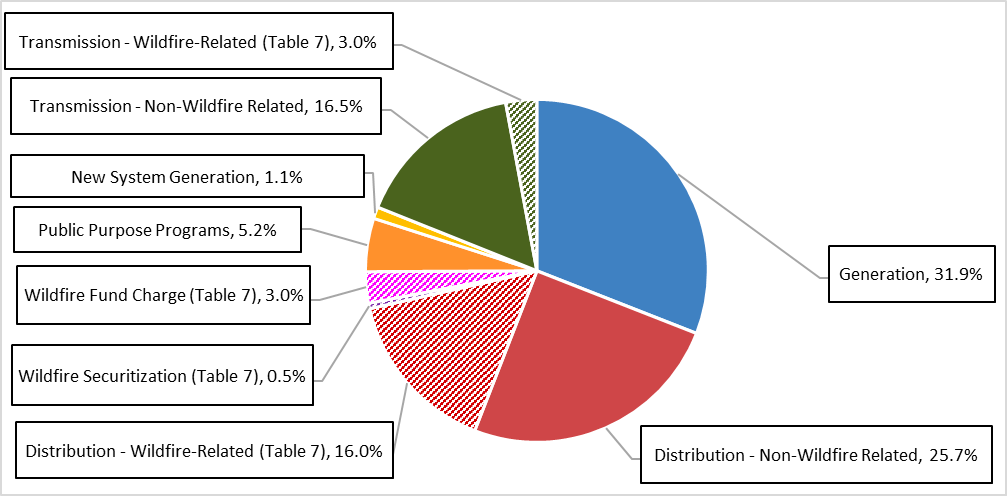

Altogether, wildfire-related expenses accounted for almost a quarter of total revenue requirements for PG&E in 2022, as shown in the pie chart.

PG&E’s 2022 year-end total system revenue requirement (PDF) by rate component, with additional wildfire-related revenue-requirement breakout.

Source: CPUC report to California Legislature, 2023

Cost adjustments can also happen between rate cases, through riders for specific unanticipated expenses. The state auditor found that operating expenses increased between 5 and 37 percent between the two most recently approved general rate cases. The rider approved in March for PG&E covers the billions of dollars in spending on—you guessed it—more wildfire costs from 2020 to 2022.

Costs on Top of Costs

California electricity customers also pay for expenses that are not in the rate base, but tacked on as extra fees. These too mostly cover wildfire costs.

The Wildfire Hardening Charge pays for $1.4 billion in bonds (PDF) that PG&E has issued to cover the cost of power line improvements. Likewise, the Recovery Bond Charge pays for “certain costs related to catastrophic wildfires,” adding another 0.5 cents/kWh on average.

A separate Wildfire Fund Charge collects about $1 billion (PDF) per year from all California utility customers to fund the California Wildfire Fund of the state Department of Water Resources, to reimburse customer claims arising from wildfires caused by a utility company.

Then there is the Power Cost Indifference Adjustment paid by customers of Ava and other CCAs to pay for the “above market costs for electric generation resources that were procured by PG&E on their behalf,” even after leaving PG&E service. Ava customers paid almost $280 million in 2021, or 4.3 cents/kWh. But that number fell to only $12.6 million in 2023, or 0.2 cents/kWh.

And there are a host of public-purpose programs, such as gas and electric efficiency programs and bill assistance for low-income customers. The largest of these, the California Alternate Rates for Energy program, cost almost $1 billion (PDF) just for PG&E customers, and $2.4 billion statewide, in 2022. About 1.5 million PG&E participating households received average monthly bill discounts of approximately $52 for electric bills and $14 for gas. Another quarter-billion dollars goes to Family Electric Rate Assistance and the Energy Savings Assistance program, which provides energy-efficiency upgrades.

These programs provide a critical safety net for millions of households, but could be more equitably supported by taxpayers instead of ratepayers, as social-benefit programs.

Ava’s Role in Rates

As mentioned before, Ava’s primary role is to procure electricity on behalf of its customers, while PG&E continues to manage delivery. Delivery costs have long been greater than generation costs, and are rising faster now.

Ava’s generation costs are indeed rising, driven by inflation, intense demand for clean energy from both power marketers and corporate buyers, and a dynamic global market for equipment. While solar power is the cheapest form of new generation, new projects in California need to come with batteries, since daytime power generation is getting saturated by abundant solar power. Batteries add capabilities and value, but also cost more.

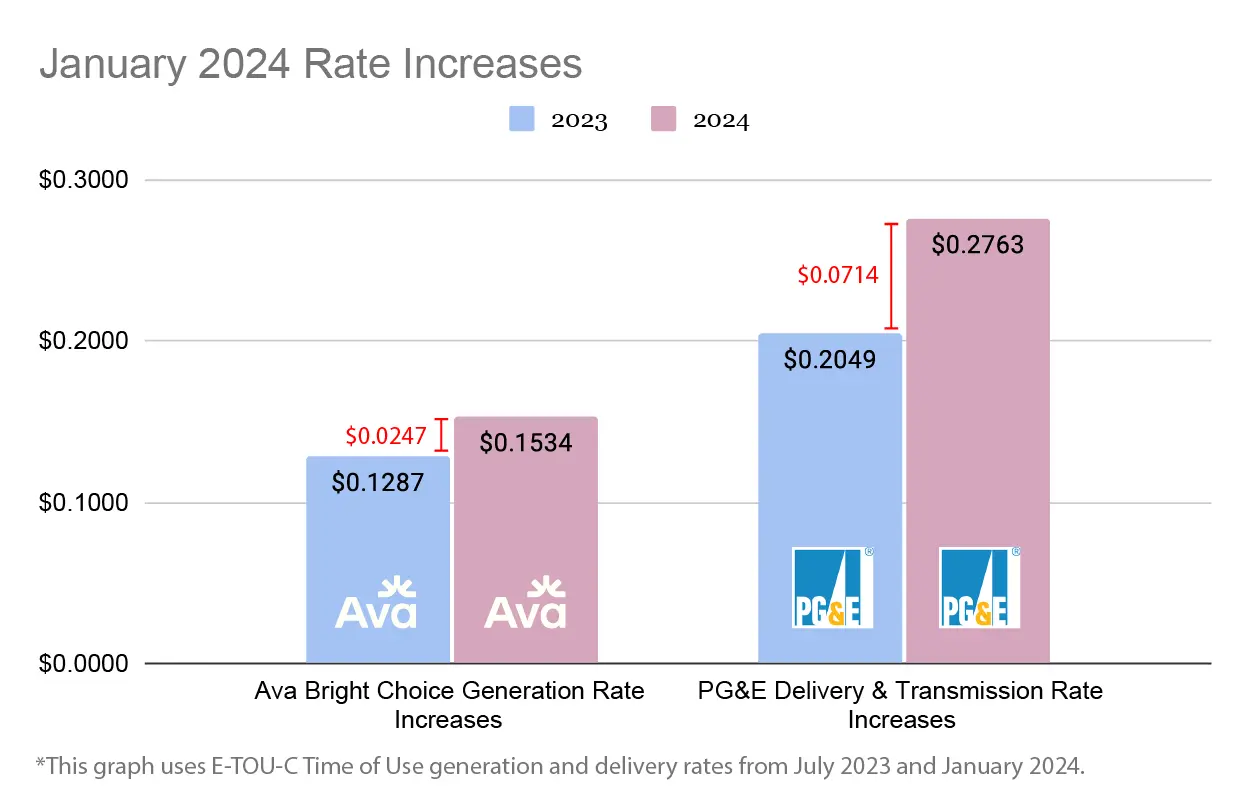

Ava’s rates are set by our board, elected officials from our member jurisdictions. Because the board has tied Ava’s rates to PG&E rates—but with a discount—Ava rates are getting pulled up as PG&E rates rise. Following PG&E’s rate increase, Ava rates rose 19 percent in January, with generation costs rising 2.5 cents/kWh on average. PG&E’s delivery rates rose by 35 percent to 27.6 cents/kWh.

E-TOU-C time-of-use generation and delivery rates from July 2023 and January 2024.

Source: AVA Community Energy

As a result of this dynamic, Ava has been generating budget surpluses. Since we are a nonprofit, no money goes to shareholder dividends. Instead, the Ava board voted in December to return $16 million to customers, including a one-time $50 bill credit to 115,000 residential customers on rate-discount programs. An expected 2024 surplus (PDF) could offset more than half the cost of PG&E’s rate increases. Additional funds are going to local programs, such as local rooftop-solar and storage projects that benefit low-income households and communities, or are used to expand financial reserves, or to buy more renewable energy.

Consequences

Rising electricity costs are creating consequences for California beyond household budgets. The move to cut global-warming pollution hinges on electrification. But as electricity rates rise, going all-electric becomes less financially attractive.

The move to income-graduated fixed charges, approved by the CPUC recently, is a modest step toward addressing this issue, though with likely negative effects on most Ava customers. The decision imposes fixed charges of $6 per month for CARE customers, $12 for FERA customers and $24.15 for everyone else. Electricity delivery rates would drop by 5 to 7 cents/kWh.

The change will fall disproportionately on households in mild climates that have low energy consumption — such as many Bay Area Ava customers. An Ava staff analysis (PDF) found that 77 percent of Ava customers would pay more under the CPUC plan, including 55 percent of CARE customers. Perhaps the lower electricity rates will promote electrification, though as rates continue to rise anyway, it becomes harder to make the case for electric cars and heat pumps.

Forecast for the Future

Are rates going to rise forever? Can we do anything to reverse the trend?

Recent filings suggest 2025 rates may come down a bit, largely driven by lower energy prices this year from January to April. But the structural trends don’t look promising.

In a report to the Legislature (PDF), the CPUC warned that further cost increases are on the way. “Wildfire risk mitigation costs are projected to continue their upward trend” in coming years, commissioners wrote. They reported that the three large electric investor-owned utilities spent $20.7 billion on wildfire mitigation in the 2020-2022 cycle, and plan to spend another $26.2 billion for the 2023-2025 cycle.

“The order of magnitude of these costs shows the scale of the problem that California is facing: climate change is escalating, with stronger storms, hotter temperatures, and conditions that increase the risk of catastrophic wildfire,” CPUC members wrote.

Indeed, in its wildfire mitigation plan (PDF), PG&E reports that over half of its service territory lies in high-risk areas—covering 5,500 line-miles of transmission and 25,500 line-miles of distribution assets—but serving only 10 percent of its customers. In 2021, PG&E announced its intention to underground 10,000 of those miles. With current costs of about $3 million per mile, the total cost could be $30 billion.

Costs may also rise if utilities don’t spend billions on wildfire safety improvements. Investors may require higher returns due to the enormous liability that PG&E and other utilities have faced—PG&E has paid $24.5 billion in damages due to wildfires, the direct cause of its 2019 bankruptcy. Some investors are pushing states to assume liabilities to “shift the burden away from utilities.”

Investor Warren Buffett, whose Berkshire Hathaway owns the Western utility PacifiCorp—which is being sued for $30 billion for allegedly starting fires in Oregon—has suggested investors will abandon high-risk areas (PDF) altogether.

PG&E’s northern California service territory has turned out to be a dangerous place for utility services. Safety is not optional, and must be addressed. But utility bills are not an endless supply of funding. While Ava does not manage wires and is not responsible for these problems, our customers are being asked to pay for the solutions. Endlessly rising costs are putting our climate and social-equity goals at risk, and raising questions of fairness.

Arguably, wildfire prevention and climate action benefit all of society, and should be paid for accordingly. Since income taxes are paid more by the wealthy, and charges on utility bills are paid by everyone, funding social goods from the state general fund would be more progressive.

One recent bill that Ava supports would create a new Climate Equity Trust Fund to cover costs for building electrification and bill-payment assistance, with funds provided by the Legislature and other sources. Wildfire safety would be another appropriate subject of funding. Shifting costs off of utility bills would be the surest way to reduce pressure on rates and make the shift to a clean and equitable energy future easier.