Myth Of The Month: CCAS Don’t Sign Long-Term Re Contracts

January 7, 2019

In this new feature, we explore myths around community choice aggregation. If you have a suggestion for myth of the month, send it to info@ebce.org.

As community choice aggregation (CCA) ramps up around the state, a myth has taken hold that CCAs are not signing contracts for new energy supply. But new data released shows that CCAs have been busy contracting for over 2000 MW of new renewable energy, with more to come.

“These programs produce very little new renewable energy, instead buying from existing sources, including out-of-state wind and solar farms,” wrote Jerry Sanders, former mayor of San Diego and head of the San Diego Regional Chamber of Commerce.

So what is really going on? As customers departed in droves for CCAs throughout 2017 and 2018, investor-owned utilities have been left with an excess of the renewable energy they need to comply with the state renewable portfolio standard (RPS). As a result, IOUs did not conduct annual RPS solicitations in 2016 or 2017, nor did they plan to undertake solicitations in 2018, according to the CPUC’s RPS annual report, released in November.

The report says that the nine CCAs in service in 2017 had an average RPS position of 49%, also well ahead of RPS schedules. But load served by CCAs is rapidly increasing, with ten new CCAs starting up in 2018. “As the RPS requirements increase and more CCAs fully come online,” the CPUC report says, “there will be a near-term renewable procurement need.”

In total, the CPUC says CCAs will need to procure “approximately 6,900 GWh beginning in 2020,” plus more to meet the 60% RPS target by 2030.

And CCAs are busy doing exactly that.

Two Gigawatts, So Far

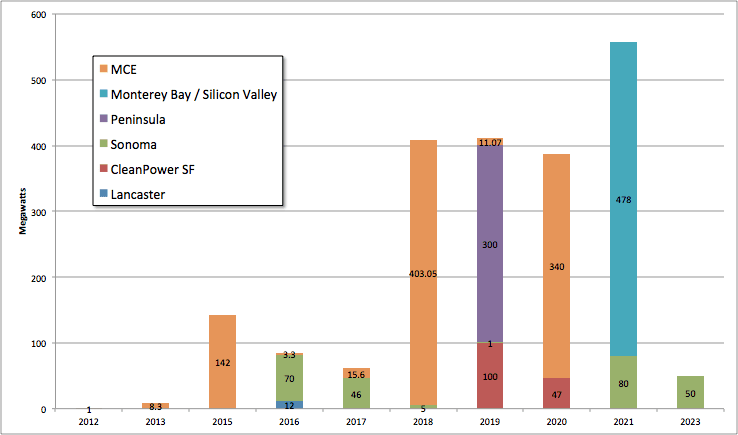

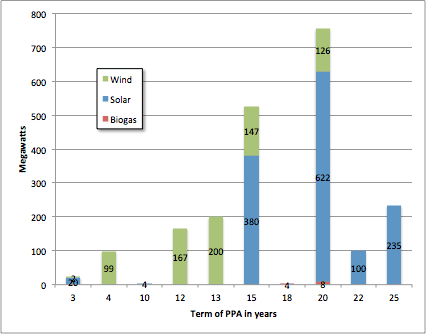

The California Association of Community Choice Aggregators (CalCCA) recently released data showing that six CCAs have so far signed long-term contracts for over 2000 MW of new renewables. Of the 56 contracts they tallied, 38 are for 20 years or longer. Only three are less than 10 years.

CCAs passed the two gigawatt milestone in October when Monterey Bay Community Power and Silicon Valley Clean Energy jointly approved contracts for 278 MW of solar, coupled with 340 megawatt hours (MWh) of battery storage for two separate projects to be built in Kern and Kings Counties. That is the largest solar + storage procurement to date in California. That same month, Peninsula Clean Energy broke ground on a 200 MW solar project supported with a 25 year contract.

Altogether, CCAs signed up for about 1000 MW of new renewables under long-term contracts in 2017. And more contracts are on the way. So far, every CCA in California plans to procure more renewables than is required under the RPS, and sooner. Most are being driven by their member communities. Ten communities in the Clean Power Alliance (CPA), for example, recently voted to go 100 percent renewable as soon as CPA starts operations next year.

CCAs that are just getting started (like EBCE) are proving ready to solicit long-term contracts right out of the gate. In June of this year, even before its residential launch, EBCE issued a solicitation for multi-hundreds of megawatts of California-based renewable energy from new projects, with at least 20 MW from local projects.

Contracts big and small

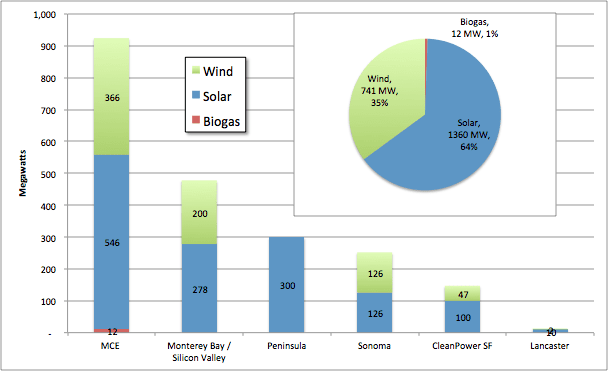

The contracts signed to date support 1360 MW of new solar, 741 MW of new wind, and 12 MW of new biogas. Interestingly, all but one of the projects are in California, belying the related myth that CCAs are supporting “out of state” power suppliers. (See map below.)

MCE Clean Energy, the oldest CCA, has signed the most contracts, at just over 900 MW. MCE’s diverse portfolio includes 36 contracts ranging from 3 to 25 years in length, and from 60 kilowatts to 160 MW. Over 400 MW of their new renewables capacity came online this year. MCE got a favorable review and rating from Moody’s Investors Service in May, the first CCA to be rated.

Monterey Bay Community Power and Silicon Valley Clean Energy have teamed up on their procurement efforts, signing contracts for three big wind and solar projects — coupled with batteries — that will come online in 2021. The average length for those contracts is 16 years. Monterey Bay is in its first year of operations, serving residential customers on July 1, 2018, while Silicon Valley went live in April 2017.

One of the smallest CCAs, Lancaster Clean Energy, has set “a lofty goal of becoming the nation’s first net-zero city.” Lancaster, a desert town of 160,000, was the first city in America to require all new homes to have solar, and has converted all city buses to electric. Lancaster Clean Energy took a step toward that goal by signing a 20-year contract for a 10 MW solar farm just outside of town, enough to power 1800 homes.

While 2000 megawatts is an impressive start, more needs to be — and will be — procured. Gov. Jerry Brown signed SB 100 into law in September, committing the entire state to at least 60 percent renewable and 100 percent zero-carbon power by 2045. Community choice aggregators will be on the front lines of achieving that goal as quickly, as reliably, and as affordably as possible.